By SIMON CONSTABLE

The recent bank run and then failure of Silicon Valley Bank kicked off a mini crisis that’s already being made worse by the government.And it could even morph into a far worse downward spiral if Federal regulators don’t back off, according to a recent report.

“More penetrating government control of the banking industry will not change human nature,” states the research note from financial analytics company HCWE & Co. “What it will do is to degrade the economy by increasing the cost of banking.” Read more here.

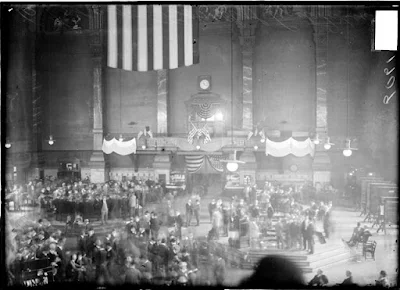

USCapitol, Public domain, via Wikimedia Commons

.jpg)

.jpg)

.jpg)

.jpg)