By SIMON CONSTABLE

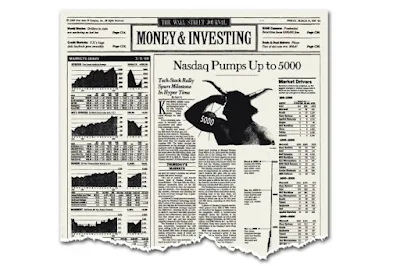

On March 9, 2000, the tech-dominated Nasdaq Composite Index surpassed a then-staggering 5000 for the first time, up from its first breach of 1000 in July 1995.

“It is a crowning milestone in investors’ unprecedented love affair with technology stocks,” The Wall Street Journal wrote at the time. “It’s hard to believe, but the Nasdaq Stock Market is still a 20-something.” It was formed in 1971 and included American Express and Anheuser-Busch, both of which eventually moved to the New York Stock Exchange.

Sam Stovall, chief investment strategist at analytics company CFRA, says the late-1990s surge resulted from several factors. “It was overly exuberant earnings projections, fear of missing out, and a constant reminder of being in a new era and that this was different,” he says.

The day after the 5000 milestone, the index set its then-record of 5048.62, but that top didn’t last long. The index tumbled by 77% to its trough in early October 2002.

The initial break in the index came when Yahoo reported data showing the number of people looking at the site fell disappointingly short of expectations. Read more here.

No comments:

Post a Comment