Traditionally, UK employers have wanted new hires to stick around for at least a few years. Late last decade, the average tenure of a UK employee was five years. But the job market keeps shifting—fast.

It might be hard to imagine Moby as anything other than an uber-famous artist, musician, and DJ. But once upon a time, he lived in a disused factory in Connecticut, paying the guards $50 a month to look the other way. In the big scheme of things, that wasn’t so long ago — 1989.

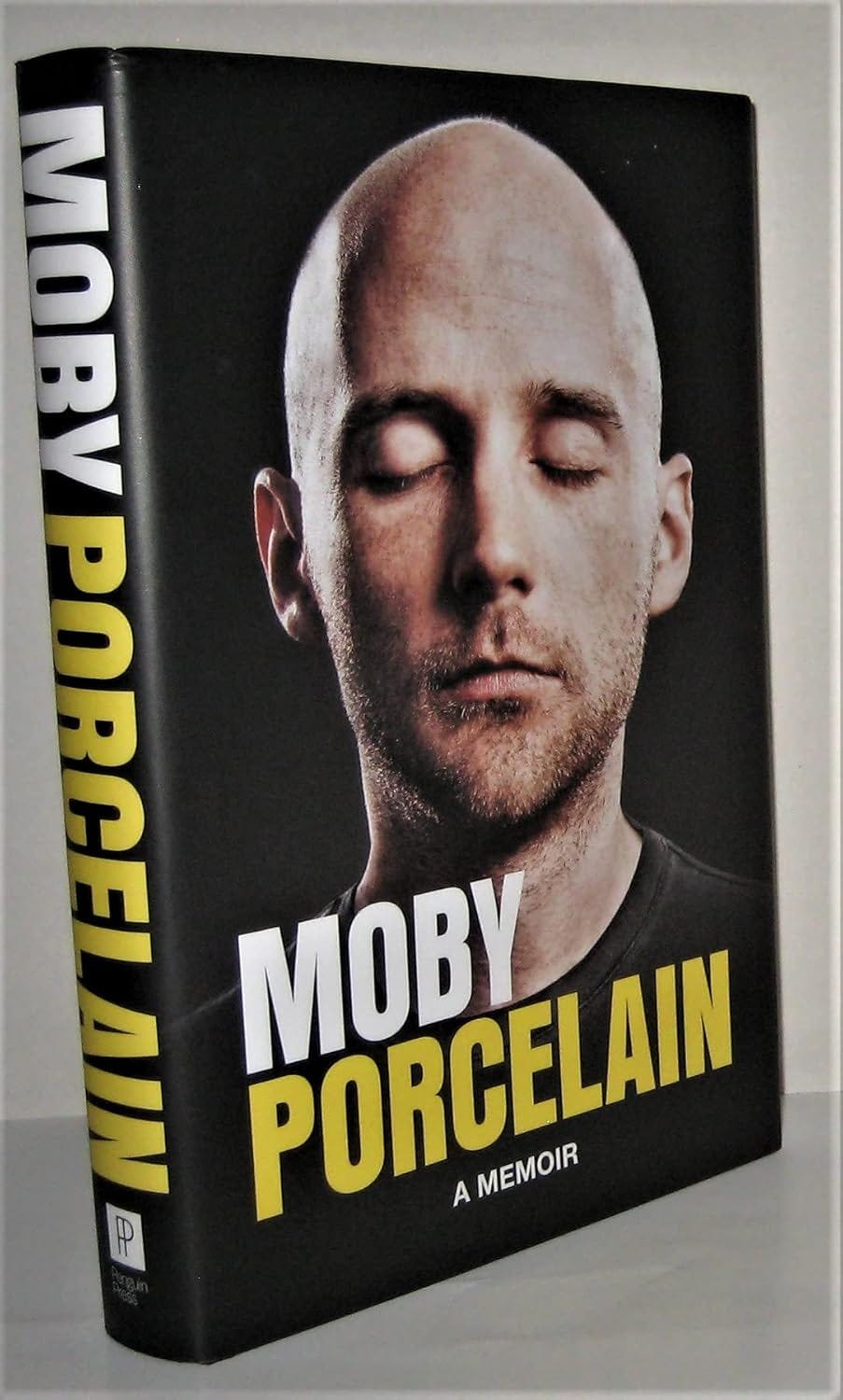

That’s basically where Moby’s book, Porcelain, starts. It then moved location to New York in the early 1990s, a time and place with which I am well acquainted. But that’s not why this book caught my eye.

Rather it is the way that Moby, a descendant of Moby Dick author, Herman Melville, went about creating an unlikely career for himself. Unlikely, that is, to many people in his chosen field. That is something we can all learn from. Here are some key takeaways from his story:

- Cut out the unnecessary. Moby was prepared to live illegally in an abandoned factory for $50 a month. It gave him the freedom to pursue his dream. What would you give up to follow your passions?

- Don’t take no for an answer. That should be self-explanatory. There are always naysayers.

- Don’t be pigeonholed. Moby is a devout Christian who also navigated the wild, drug-fueled club scene of 1990s Manhattan.

- Take the path less traveled. In the early 1990s, in New York, the big investment banks still held the allure of enormous riches. For many, it was the place to be. Not Moby. He took his own, albeit harder, route.

- Network. Meeting people helps you make connections to those who can help you. A truly successful person knows how hard it is starting out and will want to help.

- Bounce back. Moby describes a scene where the record needle skips over the vinyl at one of his gigs: Total failure for a DJ. He writes: “I had killed Christmas. I had stopped joy dead in its tracks.” Was it the end? Of course not.

- Remember to give back. If you don’t think you earn enough, consider this. “I was DJing regularly and making around $8,000 a year, so I figured I could afford fifty cents or a dollar for every homeless person who asked,” he writes. Even in the 1990s $8,000 wasn’t much, and there were far more homeless people in NYC then compared to now.

- Be true to yourself. Moby doesn’t drink, which is an anomaly in the club world.

- Experiment. Well, he doesn’t drink much, but there is an illuminating section of the book titled “Alcohol Enthusiast 1995–1997.”

- Shake off the haters. Following on from a scene of booing clubbers, he writes: “You can hate me, I thought, but right now I don’t care. The headliner canceled. […] but right now I’m here and I’m going to scream at the top of my lungs.” He was a hit.

Follow me on Twitter or LinkedIn. Check out my website or some of my other work here.

This is an edited version of a story first published on Forbes.com in 2016, Copyrite CONSTABLE CONFIDENTIAL 2016

.jpg)